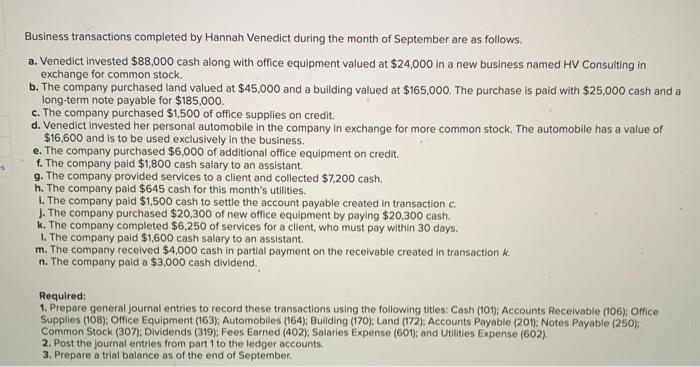

When taking out a loan, the lender has to be aware that this might be paid down. So it depends on you which have a steady flow of income out of your task.

If you decide to change jobs between the duration of pre-recognition therefore the time of buy, your own a position history and you may earnings load dont suggest as much. When you’re modifying a career doesn’t usually end in a problem there are issues which can of course cause problems. Altering efforts in same profession is ok of course you are a beneficial salaried personnel. Switching operate may cause facts when all following was involved: commission money, bonus income, bargain or brief employment, 1099 a career or mind-work. Along with these scenarios, a reputation income must be sure future earnings traditional and meet the government’s Power to Pay back advice.

#5. Debt in order to income proportion isn’t really lower adequate

As well as the matter you have saved up to have a deposit, mortgage processors will even go through the number of loans your features as compared to your revenue inside Arizona condition. This will be called the debt to help you income ratio (DTI). Already into traditional, FHA and you can Virtual assistant loan programs, you could potentially will become approved with percentages all the way to fifty% having compensating activities; not, on the jumbo and non-conforming loans we offer maximum recognized personal debt to help you earnings proportion are 43%. In the event the DTI exceeds it you are going to most likely become declined home loan resource.

To evolve your DTI, lower people financial obligation you’ve got to your figuratively speaking, vehicles repayments, otherwise credit debt, an More Bonuses such like. before you apply getting a home loan. To help you determine your debt in order to income proportion, make sense all your monthly personal debt repayments, such as education loan or vehicle payments and you may divide you to number by the disgusting month-to-month earnings. Prior to settling loans in order to be considered it is crucial your complement with a skilled Loan Officer who can review your role and you can indicates about what methods for taking in order to qualify.

#six. Perhaps not becoming state-of-the-art on your fees

Be certain that you’re up-to-date with your revenue fees. Financial lenders normally pick that-a couple of years from private taxation statements, organization taxation statements for folks who individual a business, or W-2s otherwise 1099s. Your earnings taxation will help decide how far you really can afford today and from life of the borrowed funds so not becoming up-to-date with your revenue fees should be damaging during the your loan edibility. If you haven’t submitted tax statements this can end in major affairs from inside the earnings recognition procedure even if you was very first pre-accepted for a financial loan. For those who haven’t registered definitely display this at the beginning of brand new pre-approval process so facts dont develop after you have property not as much as offer having earnest currency transferred.

#eight. This new Assessment was less than the selling price

Often delivering refuted home financing is beyond their handle. In case the family that you’re in search of to find are appraised at a cost that is lower than the newest price otherwise the quantity you are inquiring to help you obtain, the financial institution doesn’t comprehend the family worth just like the adequate to help the amount which is getting lent and will most likely refute your application. Alternatives in this case are to negotiate into the provider to help you reduce the price otherwise place extra money down seriously to compensate with the lowest worthy of. Mortgage lenders tend to ft the brand new downpayment percentage into the straight down of your conversion speed otherwise appraised well worth.

Financial Denials are Hard

It is frustrating to have your request financing refuted. Thank goodness, skills this type of well-known reasons helps you avoid which deflating experience or discover things you can do just after getting refuted an effective home loan. Think about many of these you’ll be able to problems when you make an application for home financing. And believe in the services of your trusted mortgage professionals during the Sammamish Home loan.